HOUSTON REAL ESTATE KICKS OFF 2021 WITH GUSTO

Homebuyers continued to take advantage of historically low interest rates in January, snapping up homes still on the market

HOUSTON — (February 10, 2021) — Even as the supply of homes across the greater Houston area continues to shrink, homebuyers were out in force in January, snapping up properties that were still on the market and extending the breakneck momentum with which 2020 ended. The luxury housing segment drew the strongest sales activity during the first month of the new year, with homebuyers also driving brisk sales among mid-range homes.

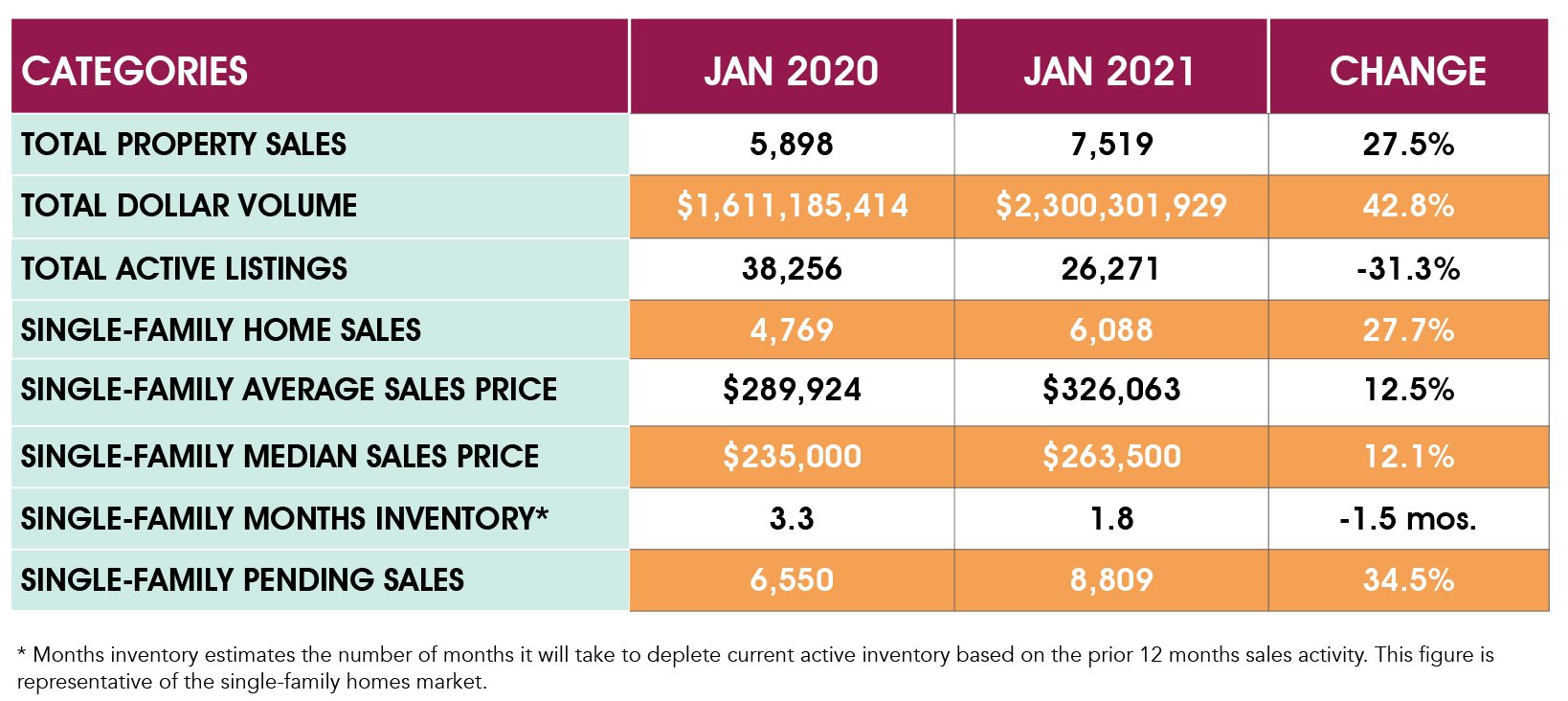

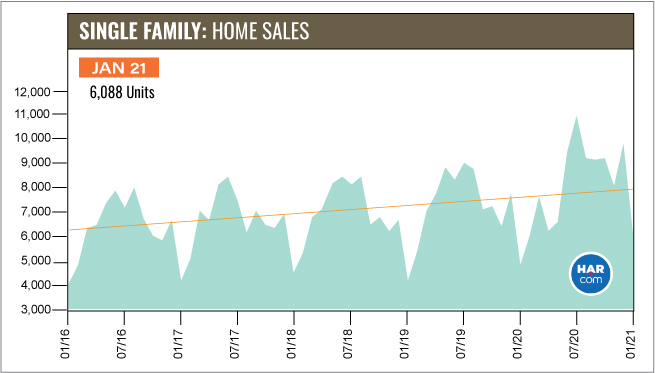

According to the latest Houston Association of Realtors (HAR) Market Update, 6,088 single-family homes sold in January compared to 4,769 a year earlier. That accounted for a 27.7 percent increase and marked the eighth straight month of positive sales.

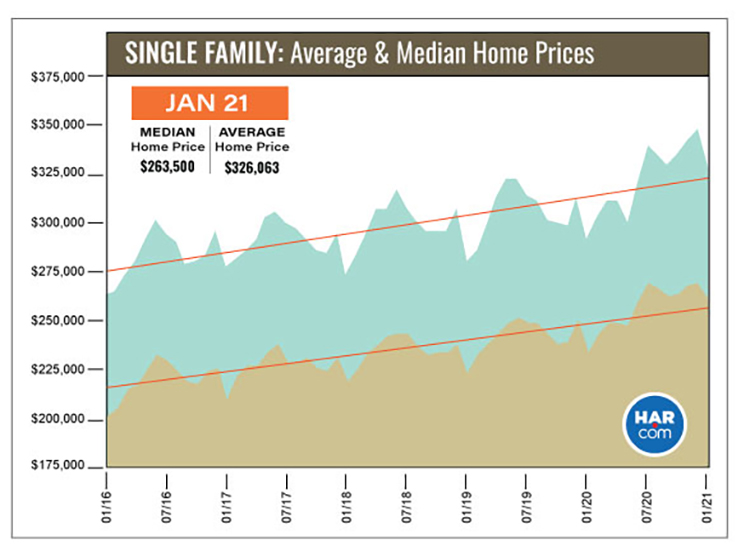

Homes priced at $750,000 and above rocketed 73.9 percent compared to January 2020. That was followed by the $500,000 to $750,000 housing segment, which jumped 70.4 percent year-over-year. Homes between $250,000 and $500,000, which comprise the market’s biggest share of sales, shot up 61.9 percent. The single-family home average price climbed 12.5 percent to a January high of $326,063 while the median price increased 12.1 percent to $263,500 – also a January high.

Sales of all property types totaled 7,519 – up 27.5 percent from January 2020. Total dollar volume for the month surged 42.8 percent to $2.3 billion.

“The Houston real estate market carried the momentum of 2020 into the new year, however we believe that the current pace of sales is unsustainable without an infusion of new listings into the marketplace,” said HAR Chairman Richard Miranda with Keller Williams Platinum. “It’s our hope that as we move out of the winter months, more sellers will begin to put their homes on the market and help boost inventory to pre-pandemic levels.”

Lease Property Update

The Houston lease market experienced a sluggish January. Leases of single-family homes fell 18.4 percent year-over-year while leases of townhomes and condominiums tumbled 6.3 percent. The average rent for single-family homes increased 6.0 percent to $1,889 while the average rent for townhomes and condominiums increased 0.9 percent to $1,607.

January Monthly Market Comparison

Houston housing registered its eighth consecutive month of positive sales in January, fueled by consumers that continued to take advantage of historically low interest rates even as their options among available homes narrowed to the most constrained levels in Houston real estate history.

Single-family home sales, total property sales and total dollar volume all rose compared to January 2020. Pending sales shot up 34.5 percent. However, total active listings – or the total number of available properties – fell 31.3 percent as new listings trickled onto the market.

A 13.6 percent year-over-year decline in new listings coupled with another strong month of sales drove single-family homes inventory down to a 1.8-months supply compared to 3.3 months a year earlier. Housing inventory nationally stands at an historically low 1.9-months supply, according to the National Association of Realtors (NAR).

Single-Family Homes Update

Single-family home sales jumped 27.7 percent in January with 6,088 units sold across the greater Houston area compared to 4,769 a year earlier. Strong sales volume among homes in the high end of the market once again pushed pricing upward. The single-family home average price hit a record high for a January, climbing 12.5 percent to $326,063. The median price also reached a January high, rising 12.1 percent to $263,500.

It took less time to sell a home than it did a year ago. Days on Market (DOM) fell from 69 to 48. With fewer new listings entering the market, inventory registered a record low 1.8-months supply compared to 3.3 months a year earlier. It is also just slightly below the current national inventory level of 1.9 months recently reported by NAR.

Broken out by housing segment, January sales performed as follows:

- $1 – $99,999: decreased 32.4 percent

- $100,000 – $149,999: decreased 23.2 percent

- $150,000 – $249,999: increased 11.3 percent

- $250,000 – $499,999: increased 61.9 percent

- $500,000 – $749,999: increased 70.4 percent

- $750,000 and above: increased 73.9 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 4,951 in January, up 32.2 percent compared to the same month last year. The average sales price jumped 15.2 percent to $321,430 while the median sales price climbed 15.9 percent to $255,000.

For HAR’s Monthly Activity Snapshot (MAS) of the January 2021 trends, please click HERE to access a downloadable PDF file.

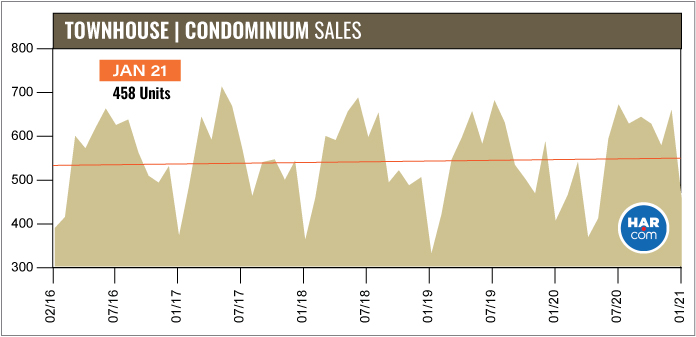

Townhouse/Condominium Update

Sales of townhouses and condominiums increased for the fifth straight month in January, rising 12.5 percent with 458 closed sales versus 407 a year earlier. The average price rose 12.4 percent to $211,188 and the median price shot up 17.0 percent to $175,500. Inventory fell from a 3.8-months supply to 3.4 months.

Houston Real Estate Highlights in January

- Single-family home sales increased for the eighth consecutive month, surging 27.7 percent year-over-year with 6,088 units sold;

- The Days on Market (DOM) figure for single-family homes dropped from 69 to 48;

- Total property sales shot up 27.5 percent with 7,519 units sold;

- Total dollar volume jumped 42.8 percent to $2.3 billion;

- The single-family average price reached a January high, rising 12.5 percent to $326,063;

- The single-family median price climbed 12.1 percent to $263,500 – also a January high;

- Single-family homes months of inventory registered a record low 1.8-months supply, down from 3.3 months before the pandemic and below the national inventory of 1.9 months;

- Townhome/condominium sales rose 12.5 percent with the average price up 12.4 percent to $211,188 and the median price up 17.0 percent to $175,500;

- Single-family home rentals fell 18.4 percent with the average rent up 6.0 percent to $1,889;

- Townhome/condominium leases dropped 6.3 percent with the average rent up 0.9 percent to $1,607.